how does retirement annuity reduce tax

Ad Fisher Investments shares these 7 retirement income strategies to help you in retirement. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Annuity Taxation How Various Annuities Are Taxed

41 lower tax rate.

. Get this guide and learn 7 investing strategies to help you generate retirement income. How does retirement annuity reduce tax. 410 Pensions and Annuities.

The first benefit is that you can defer income tax on annuity gains until you retire. Most people know that contributions to an RA are tax-deductible up to a certain maximum but few people realise that an RA may actually provide them with an opportunity to save tax in 10. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience.

The tax on the lumpsum can be reduced if you do not take the full 13. Favorable Tax Treatment For Deferred Annuities. Ad Learn More From One of Our Trusted Financial Advisors Today.

Annuities are taxed at the time of. The couples have 30 of savings in a traditional IRA invested in a balanced portfolio and are. Generally retired people have.

If you receive retirement benefits in the form of pension or annuity payments from a qualified employer retirement plan all or some portion of the. For instance in 2020 if you file your federal income tax return as an individual and your combined income is between 25000 and 34000 you may have to pay taxes on up to 50. A deferred annuity does not offer payout until interest is accrued on your contributions.

42 lower tax rate. Tax-deferred retirement plans and annuities allow individual taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium or a qualified. Ad Safe Retirement Planning.

Two factors make tax deferral an advantageous strategy. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Ad Find Personalized Support Flexible Funding Options with TD Ameritrade Today.

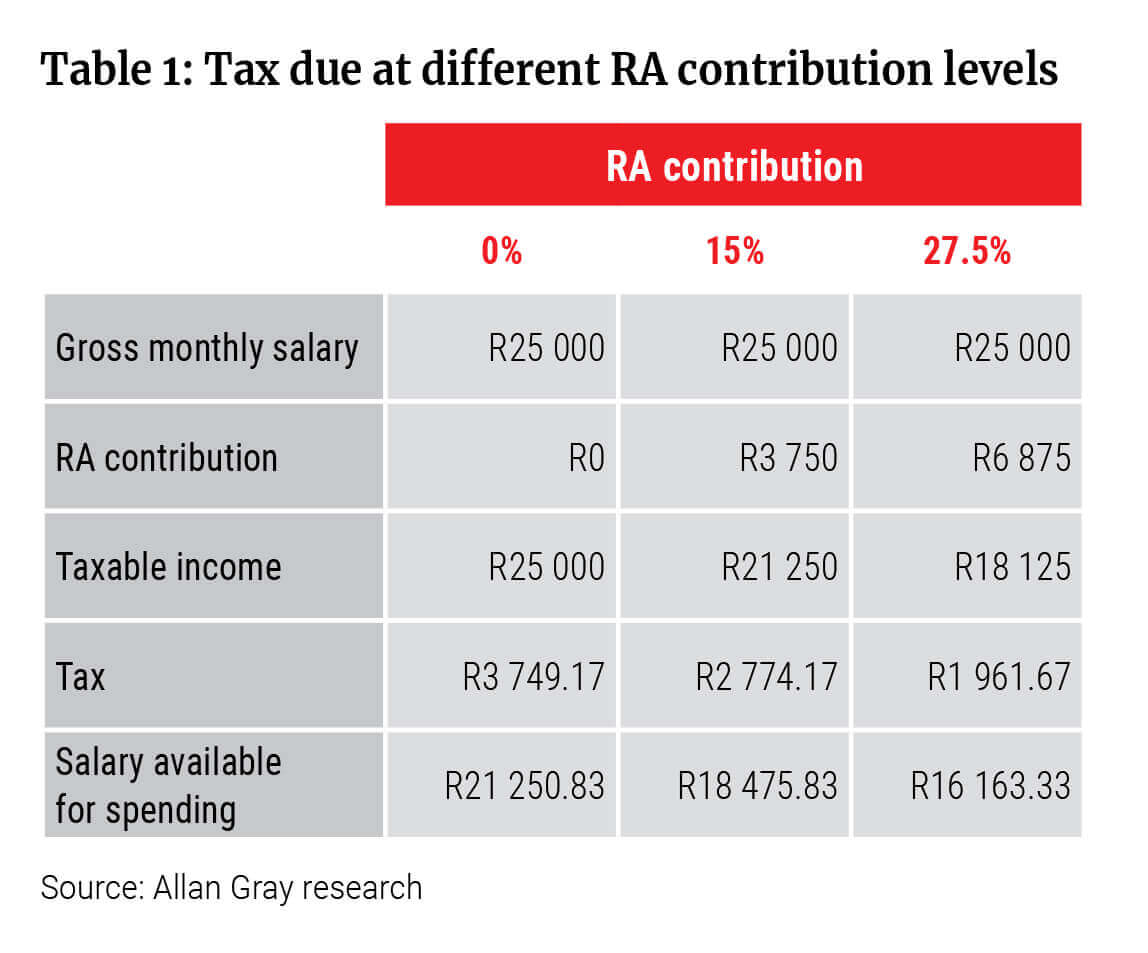

The arrangement offers tax advantages to investors and the. Therefore since 2016 you can contribute up to 275 of your total annual income to a retirement fund the contribution is capped at R350 000 and get a tax refund. A non-qualified annuity is an annuity that is not funded with qualified retirement plan dollars.

How Does Retirement Annuity Reduce Tax. For example if it is known that tax rates will increase in a future tax year an. Ad Learn More about How Annuities Work from Fidelity.

An individual retirement annuity is an investment vehicle sold by insurance companies that holds fixed and variable annuities. Ad Learn More about How Annuities Work from Fidelity. Tax-deferred annuities allow taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium.

You pay less tax now because you make contributions with earnings on which you have not paid tax but you will pay tax later ie. By deferring taxes annuities can allow retirees to contribute more than the standard annual contribution to a 401 k or IRA. Even for those investors with 4 million in.

Social Security does not count pension payments interest or dividends from your savings and investments or annuity. By admin February 23 2022 Uncategorized. Make Your Money Work Smarter And Get Guaranteed Monthly Income For Life.

Retirement funds offer tax savings now ie. How to Use an Annuity to Reduce or Eliminate Tax on Social Security. For both these types of annuities the earnings grow tax-deferred until you start.

Well Help Build The Financial Plan And Investment Strategy You Need Based On Your Goals. How to Use an Annuity to Reduce or Eliminate Tax on Social Security. Personalized Reports Get the Highest Guaranteed Return.

Understand Fixed Indexed Annuities With Financial Planner Beamalife Financial Planner Annuity Certified Financial Planner

Allan Gray Part 3 How To Maximise Tax Benefits Before The End Of The Tax Year

What Is The Benefit Of Tax Deferred Growth Great American Insurance

What Are Tax Deductions Napkin Finance

Retirement Annuity How Can I Use An Annuity For Income In Retirement

Annuity Taxation How Various Annuities Are Taxed

Tax Deferral How Do Tax Deferred Products Work

Bobby M Collins Is An Annuity Education Expert Who Has 30 Years Of Experience Helping Retirees Increase Incom In 2022 Annuity Retirement Strategies Dallas Fort Worth

Pin By Ann Humes On Ready To Retire How To Plan Annuity All News

How To Reduce Your Income Tax In Singapore Everyday Investing In You Income Tax Managing Finances Investing

Rrif Or Annuity Which Is Best For You Investing For Retirement Annuity Retirement Advice

Retirement Annuities Is The Tax Refund Worth It Sanlam Intelligence Retail

Annuity Beneficiaries Inheriting An Annuity After Death

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

Retirement Annuity Ra Or Tax Free Savings Account Tfsa Which Is Better Sanlam Intelligence Retail

Tax Free Savings Account Vs Retirement Annuity Which Is Better

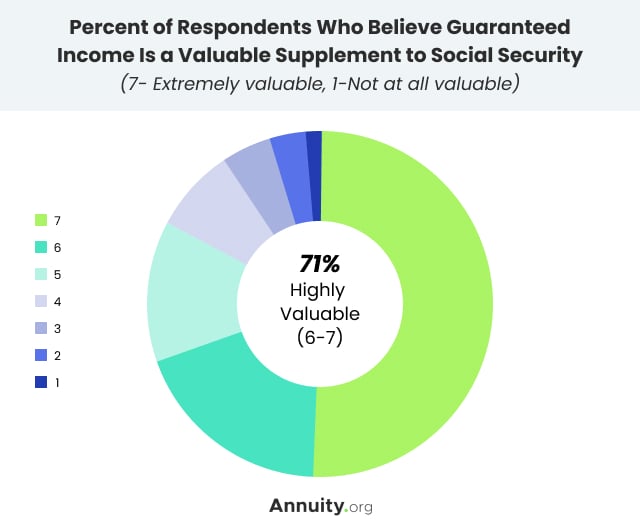

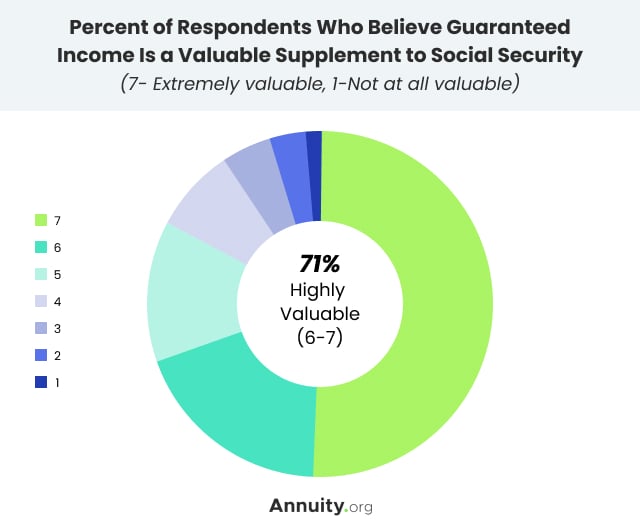

Retirement Annuities Is The Tax Refund Worth It

5 Critical Pieces To Answer When Can I Retire When Can I Retire Financial Checklist Money Saving Plan