are my assisted living expenses tax deductible

To qualify for this deduction a person must fit the IRSs definition of chronically ill meaning that they are unable to perform two or more daily acts including bathing dressing eating and using the toilet. Is caring for your aging parent or loved one on your own becoming more difficult.

Common Health Medical Tax Deductions For Seniors In 2022

Luckily some or all of your assisted living costs may be tax deductible qualifying for the medical expense tax deduction.

. Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policy holder. Is Assisted Living Tax Deductible. Below well provide an overview of home care services how to pay for home care and more to help you decide if home care is right for your.

Nearly all elder care services are tax deductible but whether you are. If youre looking for a helping hand home care is an option many families choose to make aging in place safer easier and more enjoyable for seniors. Depending on the contract other events such as terminal illness or critical illness can.

Elder care is broad term that encompasses a variety of services from part-time in-home care to assisted living facilities.

Common Health Medical Tax Deductions For Seniors In 2022

What Are Tax Deductible Medical Expenses The Turbotax Blog

10 Creative But Legal Tax Deductions Howstuffworks

Are Medical Expenses Tax Deductible Community Tax

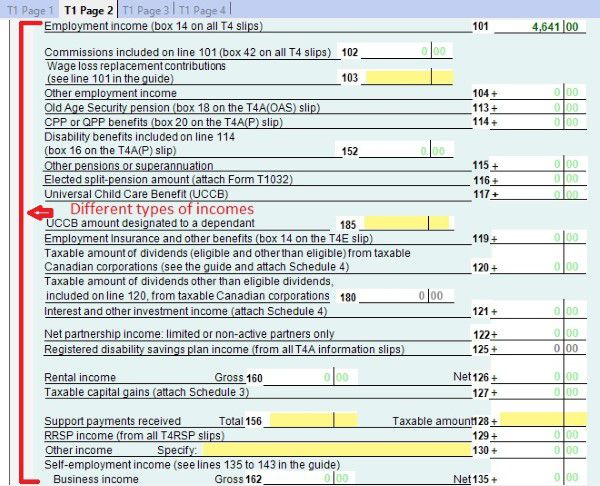

Tax Course 8 Understand Individual Income Tax Return Solid Tax

Which Dental Expenses Are Considered Deductible Medical Expenses When Filing Income Taxes 2022 Turbotax Canada Tips

Truck Driver Expense Spreadsheet Laobing Kaisuo Truck Driver Spreadsheet Trucks